By Rick Vacek

GCU News Bureau

There are many special weeks of events that educate Grand Canyon University students, but one of the most useful is Personal Financial Success Week.

According to research released this year by LendingClub Corporation, 54% of U.S. consumers live paycheck to paycheck, and 21% of the population struggles to pay its bills. Even more shockingly, nearly 40% of consumers making more than $100,000 annually fall in the paycheck-to-paycheck category.

Add it all up, and it’s preparation students desperately need before they head out into the working world.

“I think there’s a big need for this kind of information,” said Colangelo College of Business (CCOB) finance instructor Chris Calvert, who coordinated the Personal Financial Success Week program.

“Students do get information from family and friends, and some high schools are offering it more and more. But the range of questions that we tend to get from students really shows how much of a need there is to talk about it, from planning to saving to borrowing to protecting, helping put it all together and connecting them to resources.”

Resources such as Personal Financial Success Week (formerly Money Week), which has expanded beyond CCOB this year to include classrooms in the College of Education, College of Fine Arts and Production, and College of Nursing and Health Care Professions.

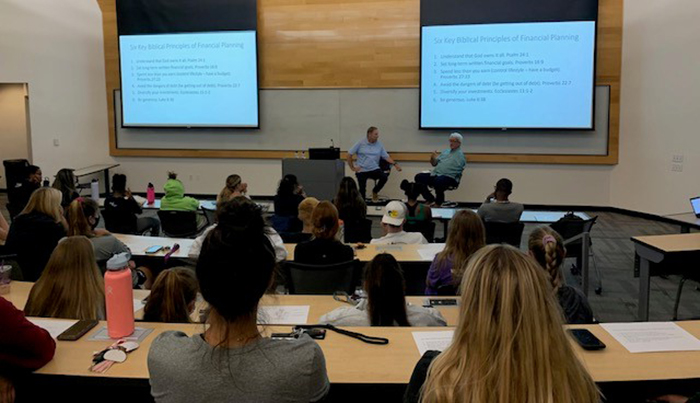

A diverse group of professionals from financial services, a church, investment companies, banks and insurance are presenting to nearly 2,000 students in more than 40 classrooms across those four colleges.

“Every year we improve our outreach and connection to GCU students on topics of financial literacy and financial wellness,” said Dr. Randy Gibb, the CCOB dean. “We have some tremendous speakers from the Valley to share the basics of money management – we want to keep it simple and encourage students’ curiosity on the topic.

“I’m so grateful for Chris leading this year’s event. She has done a tremendous amount of scheduling coordination.”

There also are special events for specific groups, tabling and hiring events, and a session with peer-to-peer consultations (see schedule below).

A sampling of topics:

- How a checking account works

- How to understand your credit score

- How to manage debt

- How to plan for the future

- What is a 401(k)?

- How to manage a checking account

- How a credit card works

- How to avoid debt or best use it

- How to ensure an income for retirement

- How to navigate insurance options

Organizers encourage students to analyze and make optimal decisions in six key areas: planning, saving, investing, borrowing, protecting and giving. The last one is important.

“If you include giving in your financial planning,” Calvert said, “it will keep giving in focus.”

The special events kicked off Monday with Ted Araya speaking to the Multicultural Club about financial perspectives and former Major League Baseball pitcher Dave Dravecky and Don Christensen from Ronald Blue Trust talking to student-athletes about their financial future.

Donald Glenn, Director of Diversity and Inclusion, said the Multicultural Club received "great information and insights" from Araya, who was relatable and sparked several questions. "This was a great event," Glenn said, "and I hope we will have even more opportunities to work together in the future."

Nicole Anderson, Associate Athletic Director for Student-Athlete Development, reported that 55 athletes attended the Dravecky/Christensen talk, asked a lot of questions and gave positive feedback.

Here’s a list of the remaining events:

- Financial Perspectives: With Ted Araya, 9 a.m. Wednesday and 11 a.m. Thursday, Commuter Lounge, Kaibab, Room 105

- Finance Alumni: With Isabelle Clawson and Brannon Walters, 6 p.m. Tuesday, Colangelo College of Business Building, Room 183

- Hiring event: 10 a.m.-noon Wednesday-Thursday, CCOB courtyard

- Peer-to-Peer Financial Conversations: With Finance Club, 6 p.m. Thursday, Student Union Promenade

- Invitation-only events: Be Your Own CFO with Jeff Rothenberg (Honors College); Financial Wellness as We Emerge on the Other Side, JJ Montanaro (veterans via Zoom)

Contact Rick Vacek at (602) 639-8203 or [email protected].

****

Related content:

GCU Today: Recent alumni are happy to invest in Money Week

GCU Today: Future teachers get in on Money Week lessons

GCU Today: Griffin offers wealth of Bible knowledge on money