GCU News Bureau

You’ve done your part and filled out all the necessary forms for Donate to Elevate, directing your state tax dollars to Habitat for Humanity, School Choice Arizona for scholarships to private schools, or to public school extracurricular programs.

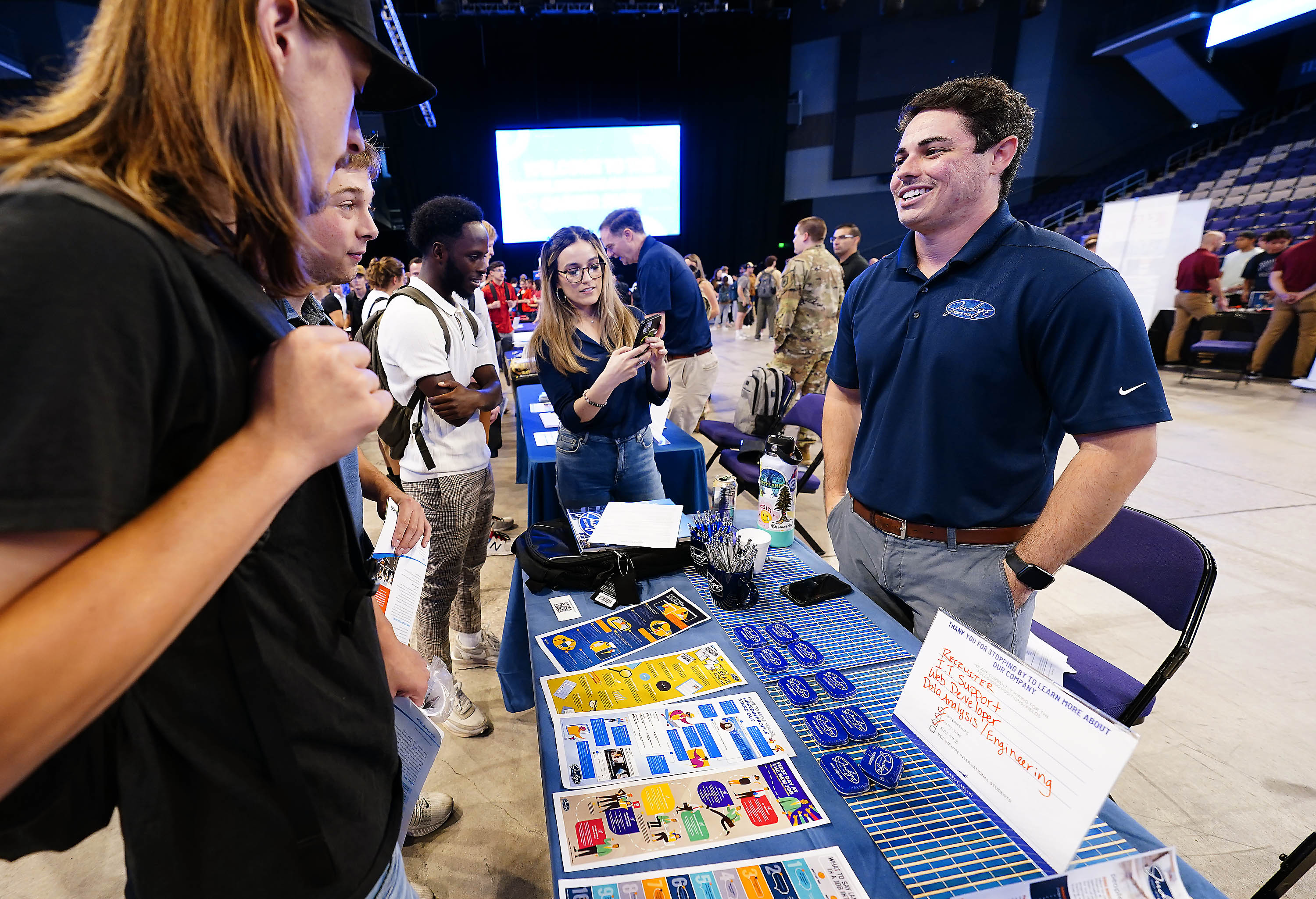

Now it’s time to do a couple more things -- make sure you get your tax credit and keep your eyes open for the Donate to Elevate Extracurricular Tax Credit Drive as part of Love Our Schools Month in February. The drive is from 11 a.m. to 1 p.m. Feb. 21 in the main lobby of Building 71 near 27th Avenue and Camelback Road and from 11 a.m. to 1 p.m. Feb. 28 on the promenade of the main campus. The goal is to showcase schools and familiarize GCU employees with their afterschool programs.

“I want Donate to Elevate to come full circle, where our employees help our community, reap the benefits of the Arizona state tax credits and put some extra money in their pockets this year since they will owe less on their taxes or get a higher return,” said Sheila Jones, program manager for Strategic Educational Alliances and Donate to Elevate.

When it comes to your tax credit, here’s what to do:

- First, watch the mail for your tax receipt letter, which verifies your donation amount. If your address has changed and you haven’t received your receipt by early February, reach out to the organization you diverted your tax dollars to – Habitat (phone 602-268-9022), School Choice Arizona (480-722-7502) or your chosen public school. Habitat says it also will be sending out electronic copies via email to each email address provided to the organization.

- If you are doing your own taxes, here are the forms you may need: Arizona Form 321 for Habitat, Form 322 for the public school credit or Form 323 for School Choice Arizona.

GCU started the Donate to Elevate program in 2013. In the years since it began, employees have given more than $7 million as of November 2017. Employees, through the University payroll system, can choose to have what they would normally pay into their state taxes diverted to Habitat, School Choice or public schools.

There is no difference in employees’ take-home pay to participate in Donate to Elevate.

The redirected funds are pretax dollars, and they count as charitable contributions. Those contributions also may be deducted on federal tax returns if you itemize your deductions, and donors receive a dollar-for-dollar credit against Arizona state taxes owed.

Jones said GCU is less than $200,000 away from its Donate to Elevate goal for this year. The University wants to reach $2.5 million of allocations by March 31, though pledges will be taken through the end of 2018 – so there’s still time to participate. If you have not yet pledged, click here.

For more information about Donate to Elevate, contact Jones at 602-639-7135 or by email.