By Rick Vacek

GCU News Bureau

Not long ago, they were Grand Canyon University students learning more about financial literacy during Money Week.

Now, as GCU alumni, they are working in the financial services industry and passing on their expertise … at Money Week.

And they’re still learning from the GCU instructors who helped set them on their way.

Colangelo College of Business alums Isabelle Clausen, Creighton Hardy, Robert Istrate and Kate Somerville are joining a star-studded lineup of speakers for Money Week: Financial Wellness 2020, which began Monday morning, continues through Friday, is entirely online and is available to all students, faculty and staff.

Contributions from current students are equally important. Members of the Finance and Economics Club, led by President Adrianna Romero and Vice President Julia Kiefer, helped CCOB Finance Chair and club advisor Mark Jacobson set up the sessions and will introduce speakers and manage the questions in the chat room.

Here’s one example of how they helped: Romero is from New Mexico and recruited one of the speakers, New Mexico State Treasurer Tim Eichenberg, for the Thursday panel discussion, “Grow and Save Your Money for an Amazing Future.”

It’s another case of GCU instructors making the best of the pandemic situation by putting it on Zoom, which means it is accessible to more people (up to 1,000 per session). Not only are the presenters sharing their knowledge, many of them are also hiring and are participating in the career fair tied to the event.

On top of that, all of the sessions will be made available for anyone who might have missed a topic they want to know more about. Each session (see schedule below) can be accessed by clicking here.

“I am very proud of what Mark Jacobson and his team of students have pulled together in a short time since the students returned to campus," CCOB Dean Dr. Randy Gibb said. "Financial literacy is so vital for our society -- COVID is highlighting the need for sound financial planning and preparation. We have organized the speakers, topics and the Zoom links; now GCU students just need to leverage the opportunity!”

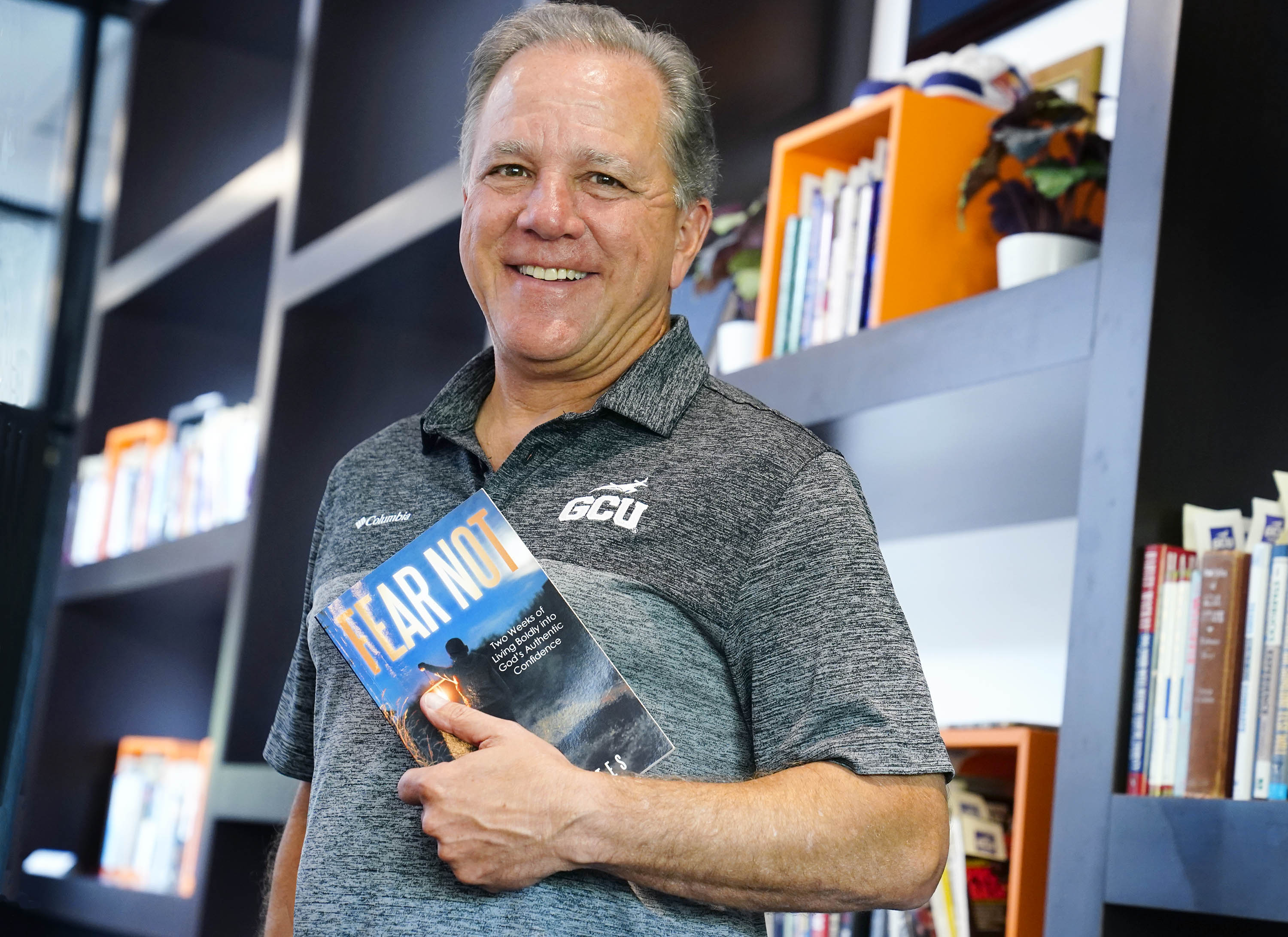

Jacobson’s style is typical of GCU instructors: He often meets one-on-one with both students and former students, hoping to either set them on the right path or monitor how they’re doing. Bringing back four alumni to speak at Money Week is a direct result of maintaining relationships he nurtured in regular meetings with them.

“I’ve never met a professor so dedicated to the business development of the school and the advancement of the school,” said Hardy, Wealth Management Financial Advisor for Northwestern Mutual and presenter on “The Basics of Personal Finance” at 9 a.m. Tuesday.

“It’s really exciting to hear all the progress reports and everything else they’re doing, how they’re doing their best to give GCU students a leg up. It makes me really proud to be an alumni and to be involved.”

Hardy was a double major at GCU – Psychology and Business Management – and started his internship with Northwestern Mutual before graduating in 2017.

“Some people ask me, ‘Oh, you’ve got a psychology degree and you’re an advisor,’” he said. “And I’m like, ‘Yeah, and I use it every day! Because money is emotional, dang it!”

Istrate, who graduated in December 2016 and just celebrated his three-year anniversary as Executive Mortgage Banker at Quicken Loans, remembered the time Jacobson told him, “Hey, maybe you should check out financial sales.”

“I didn’t even know what that meant at the time, to be honest,” Istrate said. “Starting off, I was reminded of that. Maybe he could see something that I didn’t. He was pivotal in the planning of my development and how I wound up here.”

Now Istrate talks with the assuredness of a professional who knows his craft. He’s eager to get students thinking about the future in his “Emergency Savings” sessions at 1 p.m. Tuesday and Wednesday. But he’s also eager just to help his alma mater.

“I love GCU, I love the campus and the school, and I want to give back any way I can,” he said. “It’s a big blessing, so I’m thankful for it.”

Clausen, who graduated just last April, will do two sessions: “Retirement Planning” at 1 p.m. Thursday and “Biblical Views on Money” at 3 p.m. the same day.

“I was so excited to do both,” she said. “For Christian young adults, the whole point of money in relation to Christianity is God wants us to be good stewards of our responsibilities, and one of the biggest responsibilities, especially for business students, is money.”

Ever since she was 15, Clausen wanted to work in her father’s firm, Desert Wealth Management in Fountain Hills, as a financial advisor. Now she’s doing exactly that for Robert Clausen.

“He’s actually one of my best friends – I love him to death whether he’s my father or another professional,” she said. “The fact that he and I get to work together is, honestly, a dream come true.”

Family ties also are why Somerville is working in Gilbert as a financial advisor for Edward Jones. She grew up in Minot, N.D., but when the family started vacationing regularly in Arizona, it wasn’t long before she preferred desert heat over North Dakota winters.

The 2019 graduate in Finance and Economics, the 11 a.m. Monday speaker on “Retirement Planning,” still can’t quite believe that it has been a year and a half since her commencement.

“It feels like it happened so fast, it’s a blur,” she said. “I love my job. We’re in a completely different environment (because of COVID) – wasn’t expecting that, but it’s a lot of dedication and commitment to the career. I think if you’re passionate about it, you’ll persevere and make it through.”

Perseverance also was central to the 2020 version of Money Week. Jacobson admitted that its prospects didn’t look too promising last March, but he and the students have pulled it off.

“Overall, I’m pleased, given COVID and everything,” he said. “When we started talking about this, we wondered how it’s going to work.”

It works, first and foremost, because of relationships. Like money, they’re all about investing.

Contact Rick Vacek at (602) 639-8203 or [email protected].

****

Money Week schedule

All sessions 20 minutes except where noted

MONDAY, OCT. 12

9 a.m. – “The Importance of Insurance” (Brian Martinka, WestPac Wealth Partners)

11 a.m. – “Retirement Planning” (Kate Somerville, Edward Jones)

1 p.m. – “Personal Budgeting” (Scott McLaine)

3 p.m. – “How to Choose an Employer” (Mark Gonzalez, Vanguard)

5 p.m. – Keynote speaker (40 minutes): “Money, the Bible and Living the Life of Your Dreams” (Nate Jensen, Christ’s Church of the Valley)

TUESDAY, OCT. 13

9 a.m. – “The Basics of Personal Finance” (Creighton Hardy, Northwestern Mutual)

11 a.m. – “Types of Retirement Plans” (Angelica Prescod, Edward Jones)

1 p.m. – “Emergency Savings” (Robert Istrate, Quicken Loans)

3 p.m. – “Bible and Finance” (JW Rayhons)

5 p.m. – Keynote speaker (40 minutes): “The Three Essential Money Moves for College Students” (Robert Vera, GCU)

WEDNESDAY, OCT. 14

9 a.m. – “Advice at Vanguard” (Mark Gonzalez, Vanguard)

11 a.m. – “Emergency Savings” (Robert Istrate, Quicken Loans)

1 p.m. – “Retirement Planning” (Todd Romer, Young Money)

3 p.m. – “Buying Your First Home” (Colbert Chang, wealth management advisor)

5 p.m. – Panel (40 minutes): “Spotlight on Financial Services” (Leslie Y. Tabor, Charles Schwab; Wayne Burnett, Merrill Lynch; Mark Gonzalez, Vanguard)

THURSDAY, OCT. 15

9 a.m. – “What is a 401(k)?” (Shannon Friedrich, Northwestern Mutual)

11 a.m. – “Importance of Insurance” (Brian Snow, USI Insurance Services)

1 p.m. – “Retirement Planning” (Isabelle Clausen, Desert Wealth Management)

3 p.m. – “Biblical Views on Money” (Isabelle Clausen, Desert Wealth Management)

5 p.m. – Panel (40 minutes): “Grow and Save Your Money for an Amazing Future” (Tim Eichenberg, New Mexico State Treasurer; Anna Murphy, CFA Senior Portfolio Manager; DeAnza Valencia, JD Advocacy Director)

FRIDAY, OCT. 16

9 a.m. – “Personal Budgeting” (Amy Shepard, Sensible Money LLC)

11 a.m. – “How to Choose an Employer” (Mark Gonzalez, Vanguard)

****

Related content:

GCU Today: Griffin offers wealth of Bible knowledge on money

GCU Today: CCOB job fair on the money in Money Week

GCU Today: Money Week compounds student interest in finances