By Rick Vacek

GCU News Bureau

The funny thing about personal finance education is that anyone teaching the class most likely has made the same mistakes they now are counseling against.

We all know these things … and yet we still do them. And to some of us, that’s not so funny.

But the Colangelo College of Business at Grand Canyon University is doing its part to educate students — and staff, if they’re interested and want to learn — with its first “Money Week,” which began Monday and will continue through Wednesday. Click here for the schedule of the remaining sessions out of the 14 scheduled.

In smart, focused, 20-minute talks, instructors from CCOB and experts in financial planning are covering topics ranging from how to put together a budget to how to best tackle credit card debt. “It’s like speed dating for your wallet,” is the seminar’s catchy moniker, and the ideas are most definitely worth exploring a relationship.

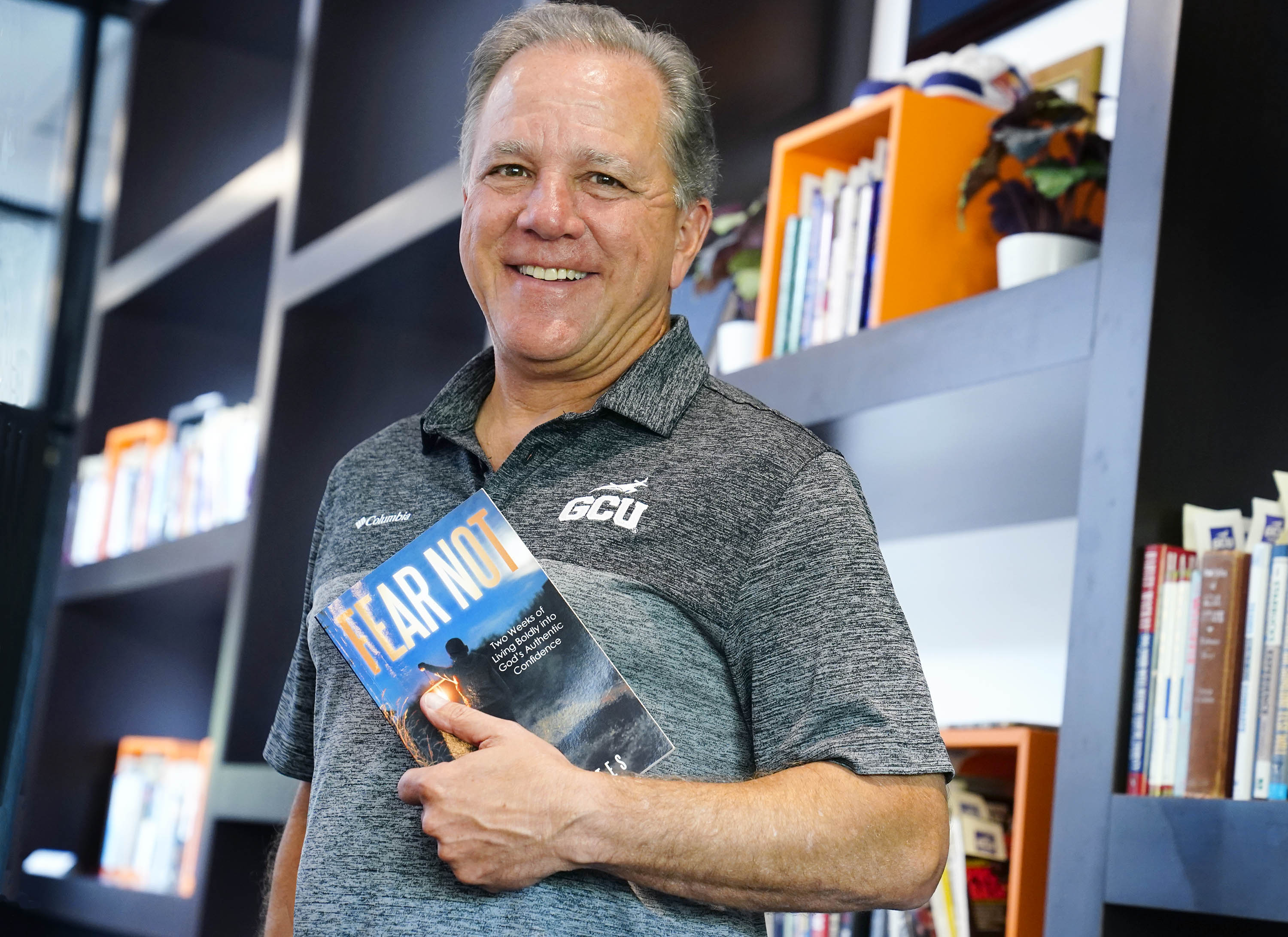

But back to those financial mistakes. When Stephen Barnes of Barnes Investment Advisory Inc. conducted a session Monday titled, “10 Things I Wish I Knew When I Graduated from GCU,” he openly shared with a room full of students how he messed up when he was younger, rushing to buy a house and buying car after car — sometimes two at a time.

“It is part of the process, and eventually it gets painful enough that you stop and figure out a better way to do stuff,” he said afterward. “I wish somebody would have told me it was OK not to buy a house — it’s OK to keep renting. ‘Got to buy a house, got to buy a house.’ It was tremendous pressure.

“Plus, I wish somebody would have said to me, ‘So why are you buying another car? Doesn’t that one work? Why don’t you save some money?’”

That was No. 4 (“Exercise Your ‘Free Won’t’”) on Barnes’ list of 10, but it was No. 1 (“Master Yourself”) that hit home with sophomore hospitality management major Sarah Mondragon.

“You don’t need to know everything about accounting or financial management,” she said. “But you need to be able to manage yourself.”

Common-sense advice

Barnes, a member of the CCOB advisory board, said he didn’t start saving until he was 29, and it took him 13 years to kill his debt. He said he drove used cars for two decades and now has his house paid off. He has been married for 32 years and has owned only two houses in that time.

“It’s human nature to want stuff,” he said. “Periodically, we go and look at houses and I want a nicer house and we could afford a nicer house, but a bigger house, the house owns you. That’s the point of mastering your mind. When you’re tempted to buy some of these things, it doesn’t mean you shouldn’t do it, but think it through.”

No. 10 on Barnes’ list was something you wouldn’t expect to hear at a financial seminar: the importance of getting enough sleep. Most Americans are sleep deprived, but countless studies have shown that you perform better when you get the proper amount of rest.

“Look at it like oxygen,” Barnes told the students. “You don’t try to catch up on breathing.”

“Money Week” was the brainchild of Ashley Hardin, a GCU admissions representative and former member of the women’s basketball team. When she graduated and started working at the University, she quickly saw that she didn’t understand the benefits package, found that she had a passion for financial planning and got her license.

Hardin had entertained the notion of playing professionally before injuries torpedoed that idea. She didn’t want to wind up like so many athletes who squander their money on expensive toys but also saw that regular students needed the advice as well.

So Hardin created a personal finance seminar that she taught last year, and CCOB also created a course, FIN 210, on the subject. “Money Week” gained traction when Dr. Randy Gibb, the CCOB dean, asked Pastor Tim Griffin, the dean of students, what the business college could do for students, and Griffin immediately replied, “Personal finance education.”

“Our objective is to increase GCU students’ awareness and interest in their personal finance, motivate students to take the FIN 210 course as an elective, and determine areas of interest to students based upon participation/attendance,” Gibb said.

Learning in the real world

Hardin, who has taught biology and chemistry labs as a GCU adjunct, did a session Monday titled, “Don’t Be ‘Straight Outta Money’” in which she used one of those acronyms that stick in your head — P.R.E.D.I.C.T. — to drive home her point. It stands for Protection management (wills, life insurance), Retirement planning (IRA, etc.), Education planning for your kids, Debt elimination (understanding the best way to get out of debt), Investment strategies, Credit management and Tax strategies.

Being an admissions rep has helped Hardin see the importance of properly allocating resources.

“I sit with families day in and day out, and even with scholarships and financial aid, they sometimes aren’t able to make it work,” she said. “I tell them, ‘Rather than spending another $200-300 on Christmas gifts, why don’t you apply it to education?’”

And personal finance knowledge is among the most important things they can learn while getting that education. College loans can take years to pay off.

“I definitely think this is information that every student needs to know regardless of their major,” Hardin said. “I’m now in the real world — what do I do?”

Barnes emphasized learning from failure and recommended reading, “The Millionaire Next Door,” the 1996 book by Thomas J. Stanley that illuminated seven common habits among the rich. But Barnes said it comes down to one simple idea.

“Say no to debt,” he said. “And in our society, that’s weird.”

Contact Rick Vacek at (602) 639-8203 or [email protected].