Photos by Ralph Freso

The three-day dockworkers’ strike in early October barely put a dent in the nation’s supply chain.

Nevertheless, it served as a warning to everyone leaning heavily on supplies that are shipped from the 36 ports on the East and West coasts of the United States.

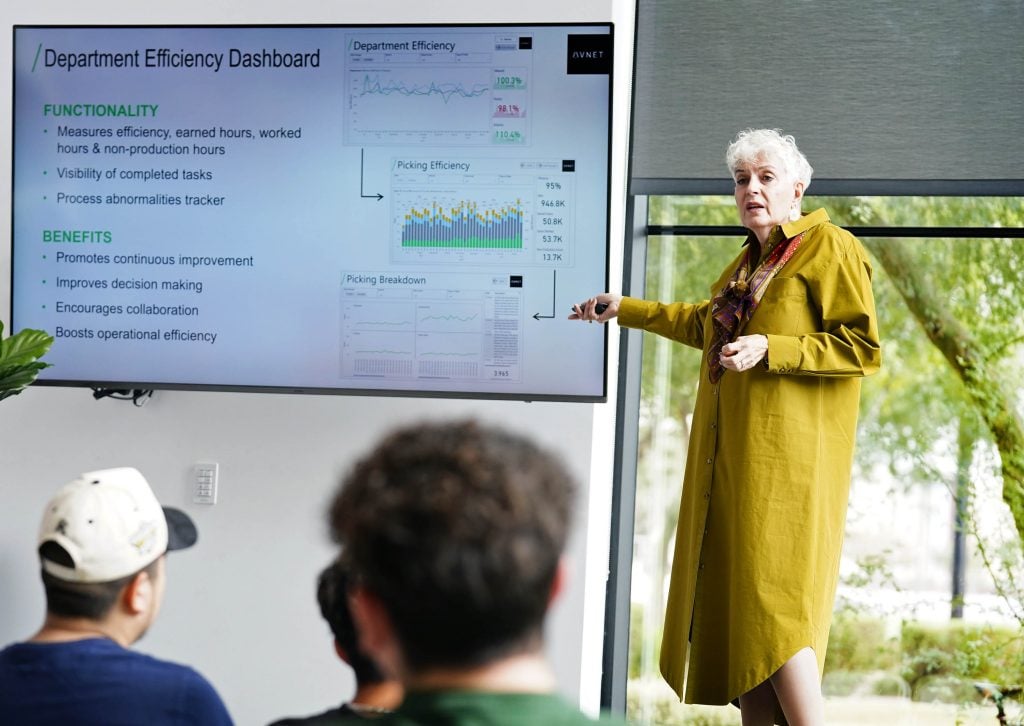

“Be flexible,” Beth McMullen, Avnet senior vice president of global operations, told students Wednesday at the Colangelo College of Business lobby as part of the T.W. Lewis Speaker Series at Grand Canyon University.

Avnet, a global technology solutions company, generated $26.5 billion in revenue in 2023 while shipping 247 billion units annually to more than one million customers in 140 countries. Much of Avnet’s business is with defense contractors, McMullen said.

McMullen’s topic was “Digitizing the Supply Chain.” She outlined Avnet’s strategies in satisfying customers while minimizing the risk of disruption, maximizing worker production and anticipating trends that could affect shipping to customers around the world.

The fact that the dockworkers' strike was suspended until Jan. 15 provided temporary relief while serving as a warning of the perils of a supply stoppage.

The COVID pandemic in 2020 impacted manufacturers and distributors, and acts of Mother Nature also affected companies and customers.

While most of the national attention surrounded Hurricane Helene in late September and recently Hurricane Milton, McMullen said she also kept a watch on a typhoon that approached Japan last week.

Because Avnet ships goods to other countries, there is an awareness to avoid sending merchandise through countries that have an embargo.

And labor also can become an issue. Avnet has 22 distribution centers in North America, Asia Pacific and Europe, employing 15,800 people. There is a considerable difference in the labor laws at facilities, such as ones in Europe that possess strong unions, and those in right-to-work states, such as Arizona, McMullen said.

Avnet’s Chandler location is the only facility that houses a distribution center, a technology campus and a device programming center.

“This (discussion) was very beneficial,” said Giovanni Giella, president of the Supply Chain and Operations Club at GCU. “I learned a lot about the supply chain industry and semiconductor world. Things are always changing, but you learn about the different risks associated with knowing how much inventory to keep.”

Giella said he gained a lot of knowledge about AI and digitization in the supply chain, particularly in forecasting inventory management, supply relationship management and global trade compliance.

The AI discussion weighed evaluating risk verses confidence.

“It’s all about planning ahead of time, knowing what risks are going to be happening with the decisions you make, but always having a backup plan,” Giella said.

McMullen reiterated a few times that the United States will impose a tariff increase on certain goods made in China starting Jan. 1, including a spike in semiconductors from 25 to 50%. Tariffs also will be assessed to hospital goods, such as respirators, facemasks, syringes and needles, and solar panel cells and modules.

Those tariffs are likely to result in increased costs for companies and consumers relying on those goods.

“You can’t anticipate everything, but there’s a way to prepare for it,” Giella said.

GCU News Senior Writer Mark Gonzales can be reached at [email protected]

***

Related content:

GCU News: Fortune 100 CEO feeds food distribution industry knowledge to students

GCU News: Business major seeks wider landscape with Real Estate Club